The Federal Government is giving eligible Australians $25,000 to build or substantially renovate their homes. While this grant has closed on 14 April 2021, a lot of Australians are still spending a substantial amount of money on renovating their homes. It has been reported that in 2021, Australians are spending a all-time record $1 billion a month on renovations. If you’re one of these Australians and want to take advantage of any and all future government stimulus, you should make sure you have read this guide on the 5 things you must know before you start and dive into the renovation process right away.

Whether you’re planning on renovating for more property value or are aiming to transform your house into the dream house, any type of renovation is a monumental task and can be really stressful. Without preparation, the renovation process can be full of mishaps and disappointments.

Renovation planning guide

To help make the process easier, we’ve pulled together the ultimate renovation planning guide. We want to make sure you have equipped yourselves with all the nitty-gritty. Here are the 5 essential things you should know before you start remodelling.

Set a renovating goal

It’s important to know what you want to achieve with your renovation and why. If you are renovating your home to give yourself and the family a house of dreams, you should be specific about design ideas. Think about how this house will service your needs in terms of functionality and design style in the future. When it comes to adding value to the property, talk to a local real estate agent is a good way to find out. Even if you are not planning to sell the house, you should still consider how a renovation could increase the property value.

Set a realistic budget

It’s important to know how much you can afford on the renovation. Your budget should be based on what are the renovation results you want to achieve, and whether it’s a big project or just renovation of some rooms such as the kitchen. You should get quotes from at least three builders and be clear about what is included. And then you can decide if you have enough cash on hand to pay off this renovation. If not, you should talk to a financial expert in terms of extending your current home loan, refinancing your home loan or getting a construction loan.

Organize your development application

Generally, most extensions of property, and sometimes renovations require a development application/assessment (DA). You should be aware that planning permission could take months to apply for and gain approval. Although depending on your local council, sometimes you can gain fast-tracked approval. We recommended you to take care of this development application early in the process if you’re aiming for a major renovation. Because you can proceed no further without the DA approval.

Engage with a registered builder

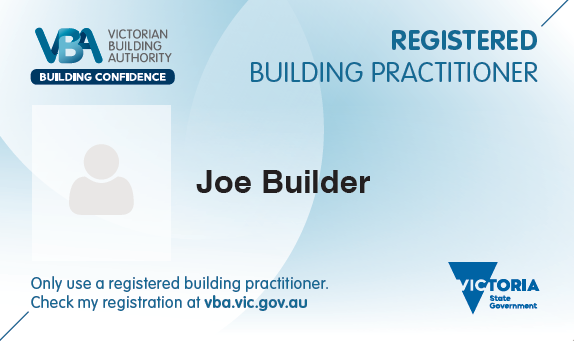

Whether you’re building a new home, adding an extension or carrying out structural renovation to your house. It’s likely you’ll need to engage a building practitioner to do the work.

According to the information provided on the VBA website, “to ensure your project is completed by someone with the necessary qualifications and experience, make sure you always use a registered building practitioner. ”

All registered building practitioners (except companies) are issued with a Photo ID card. It lists the category of registration for the work they are eligible to complete. Before engaging a building practitioner, you should check their ID card to ensure they are suitable to undertake the work. You can also check if a building practitioner or company is registered using VBA Find a practitioner directory.

If you use an unregistered builder or tradesperson to carry out work valued at over $10,000, you are at risk of having no protection from poor quality work. In addition, the work won’t be covered by domestic building insurance.

Information provided on the “engage a builder” is a selection of information taken from the Victoria Building Authority website. It may not contain all the information relevant to you.

Expect the unexpected

Each renovation brings unique twists. That’s why you should expect the unexpected by allowing extra time in your renovation planning. And set up a rainy day fund within the renovation budget to prepare for the unanticipated mishaps along the process. We always recommend people to prepare themselves both emotionally and financially.

How Credit Hub can help

We understand that during a renovation process, almost anything can happen. For professional financial advice, don’t hesitate to contact us. Our mortgage brokers in Point Cook can provide you professional sound advice on getting the most out of your renovation budget that meets your goals. We talk in jargon-free English to ensure that you fully understand your plans and options. We service Melbourne’s Point Cook, Werribee, Epping and surrounding suburbs.

Disclaimer:

The information presented by staff or employees of Credit Hub and its associated companies is provided for general informational purposes only. We do not guarantee the accuracy, completeness, or timeliness of the data or views presented. Audience members should conduct their own research and verify any information before relying on it. Credit Hub and its associated companies are not liable for any errors or omissions, or for any actions taken based on the information presented.